June 2018 Newsletter – Stock Market Predictions: Some Use Their Crystal Ball, I See the Obvious

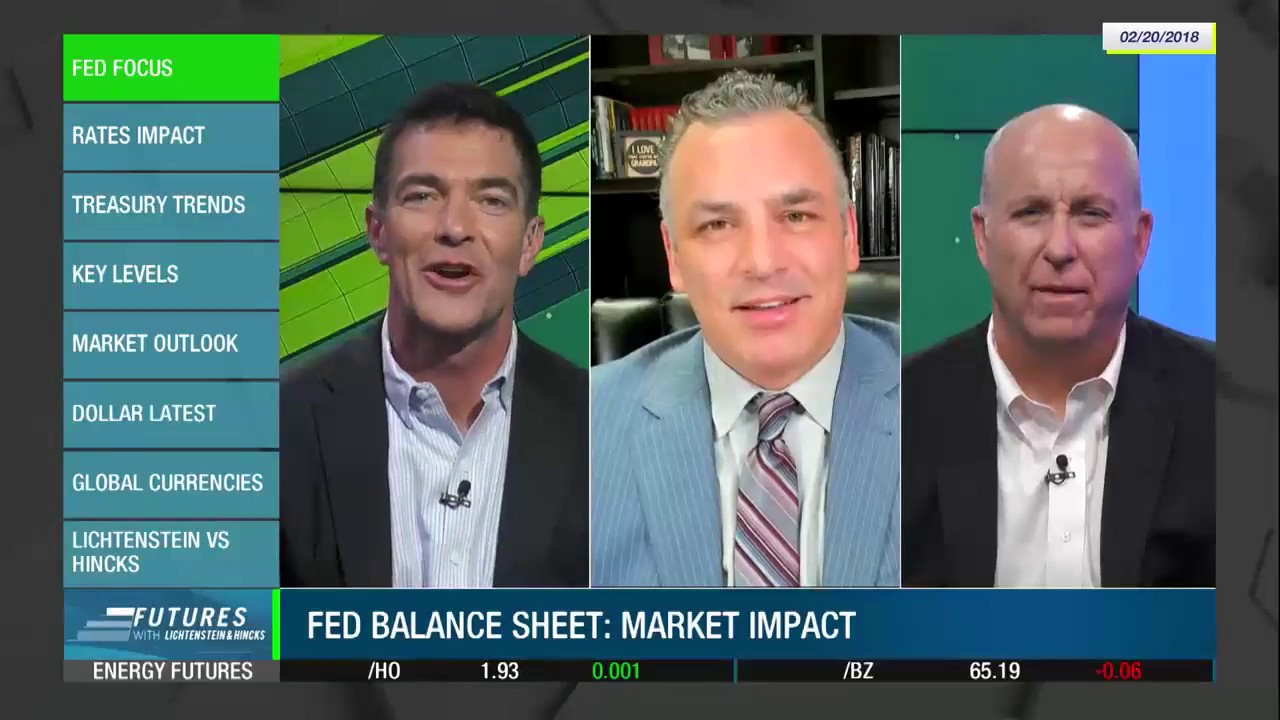

As I mentioned before, I have made many gold and stock market predictions recently that came true, even though at the time some questioned the wisdom in my prognostications. Most of my predictions were made live on national radio. Some of those recordings are archived on my website under the Radio [...]